Latest Trader Channel Posts

Short CAD

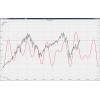

As of 23 Apr 2011 on the daily chart USD/CAD has completed a triple divergence: MACD lines, MACD histogram and Stochastics. On Thursday 21 April, we had also a “rejection tail bar” on the daily chart, very often a messenger for a price reversal.

Well, I agree that it is difficult to be overly bullish the USD with Rating Agencies like Standard & Poor´s beginning to downgrade the rating of the USA due to the budget deficit. The deficit has been there since many years now and the number of books written about it goes probably into the hundreds. And now even the laggards such as the Rating Agencies cannot afford anymore to ignore this problem in public. Therefore, an alternative to the “major USD/CAD” could be to look at the EUR/CAD pair in order to short the CAD. Admittedly, also the EUR has its problems, named PIIGS. But these problems seem to be already priced in.

Well, I agree that it is difficult to be overly bullish the USD with Rating Agencies like Standard & Poor´s beginning to downgrade the rating of the USA due to the budget deficit. The deficit has been there since many years now and the number of books written about it goes probably into the hundreds. And now even the laggards such as the Rating Agencies cannot afford anymore to ignore this problem in public. Therefore, an alternative to the “major USD/CAD” could be to look at the EUR/CAD pair in order to short the CAD. Admittedly, also the EUR has its problems, named PIIGS. But these problems seem to be already priced in.

So, let’s talk about EUR/CAD now. On the weekly chart EUR/CAD shows a 1-2-3 bottom (beginning of June 2010, mid of October 2010 and beginning of January 2011). The corresponding 1-2-3 bottom-trendline (touching prices beginning of November 2010 and mid of October 2010) has been broken to the upside mid of March 2011. Simultaneously, price has punched through the Yearly(!) Central Pivot Point at 1.3630, which acted as resistance. Since then, price has moved sideways. Consequently, a low risk long entry with support at the Yearly Central Pivot at 1.3630 is still possible. The target area for this trade should be in the range 1.4650-1.4977 where a number of Fibonacci levels are congested. In addition, the Yearly R1 Pivot Level is at 1.4814! - When you will be looking for a long low risk entry point, wait for weakness on the 4h chart or even the daily chart. Currently, the daily chart, the 4h chart and even the 1h chart show strength, but patience will yield you an attractive entry point.

If Technical Analysis reasoning is not sufficient to convince you that the CAD is a short, then how about this: the COT report is telling us, that commercial traders are extremely short the CAD since some weeks now!

If Technical Analysis reasoning is not sufficient to convince you that the CAD is a short, then how about this: the COT report is telling us, that commercial traders are extremely short the CAD since some weeks now!

To sum it up, anything can happen with CAD but the probabilities for a rise of the USD/CAD pair and the EUR/CAD pair are significantly higher than for a further decrease.

Trade safely and let the Bayesian Probability act in your favour.